With mental health ailments reaching all-time highs among the UK workforce, companies will need to take radical new approaches to maintain the wellbeing of their workforce, or risk dire consequences for their business and reputation. According to a new report, however, almost seven in ten UK managers still feel that there are structural barriers in place preventing them from supporting their staff when such issues emerge.

With mental health ailments reaching all-time highs among the UK workforce, companies will need to take radical new approaches to maintain the wellbeing of their workforce, or risk dire consequences for their business and reputation. According to a new report, however, almost seven in ten UK managers still feel that there are structural barriers in place preventing them from supporting their staff when such issues emerge.

The prevalence of mental illnesses in the UK remains high, with one in four individuals currently suffering at least one episode of some variety throughout their lives. Currently, around 8% of the population is said to be suffering from some form of depression, but while so many people are impacted, a sense of social shame still surrounds the topic, with society continuing to project negative connotations onto mental health issues, which often constitute an additional barrier to recovery faced by sufferers.

In order to combat this, a number of businesses have launched high-profile campaigns to end mental health discrimination, while thought leadership in the corporate world continues to encourage companies to take a more pro-active stance on supporting employees with their mental health. Despite this, one recent study found that while almost all employers agree that a happy worker is a productive worker, fewer than half of organisations feel they deal with mental health issues effectively in the workplace.

At the same time, only around half of UK employers actively offer any help with depression, among other disorders. A likely cause of this failure to make progress is many firms’ reluctance to address the role of financial matters as a main locus of stress in their workforce. According to that study from Barnett Waddingham, financial education is bottom of the list of the UK’s corporate wellbeing priorities, with fewer than half of organisations including it in their overall strategy, while 56% of employees said financial education should be provided in the workplace.

Following this, a new paper from global HR consultancy Mercer has further highlighted the importance of financial support in combating mental health strains among a company’s workforce. According to the firm’s ‘Solving the mental health epidemic’ report, staff on the lowest wages were most likely to have a mental health issue.

Under pressure

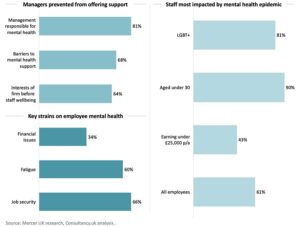

Of workers on an annual salary under £25,000, 43% of those polled by Mercer said they had a mental health diagnosis to their name, compared to only 25% of those on salaries of more than £70,000. On top of this, the 90% of employees under the age of 30 who told researchers that their mental health was currently affected by the cost of living.

Financial worries are just the tip of the ice-berg, meanwhile, as while a quarter of employees said they were struggling to make ends meet, a further one in eight people believe it likely that they could lose their job in the next 12 months, something which would see them unable to meet debt obligations, or even rent. As a result, two-thirds of employees said that their mental health and wellbeing is affected by their personal job security.

Fatigue was also noted as a key strain on employee mental health. Three-fifths said that concerns over financial matters had caused them to lose sleep, and experience a lack of concentration. This is not only likely to result in the worsening of an employee’s mental wellbeing in the long-term, but the decline of a business’ performance, with such a large portion of its staff unable to perform to the best of their abilities.

Despite the clear business case, alongside the ethical one, for caring for employee mental health, however, many managers still demonstrate a reluctance to make it a priority. When Mercer spoke to managers on the matter, it uncovered what it described in the report as a “worrying disconnect” between how well companies think they are supporting staff, and how well they really are. 81% of managers said staff mental wellbeing was their responsibility, but a shocking 64% of managers confirmed they had put “the interests of their organisation” before staff wellbeing. Following up on this, a further 68% said that they faced barriers to supporting the mental health of those they manage.

Divorced from reality

This paints a problematic picture of British business leaders on the topic of mental health. While they are willing to talk a good game, the evidence suggests that they are ultimately still pressuring their middle hierarchies to chase profits at all costs in the short-term, and failing to remove structural imperatives that make them view staff with mental health issues as “a problem”, rather than fellow staff to be supported.

Interestingly, this would be the latest in a succession of reports to find that there is a divorce between the ideology espoused in the literature of UK companies and their material actions. Recently, this saw a clear difference between how white, heterosexual, male members of UK companies perceived their diversity and inclusion efforts, and how BAME, LGBT+ and women saw them.

In this regard, Mercer’s report also highlights the matter of the UK’s lagging inclusivity efforts as a hindrance for adequate mental health support. More than 80% of LGBT+ staff are impacted by mental health issues, compared to 33% of non-LGBT+ people. Meanwhile, only 38% of BAME staff said they felt comfortable discussing their mental health, compared to 56% of white employees.

Change is clearly needed, and Mercer concluded its report by warning that the mental health crisis in Britain has now reached epidemic proportions. As a result, employers who care about maintaining a present and productive workforce can no longer think one-off initiatives and token campaigns will correct the problem.

The report concludes, “The underlying factors driving the mental health epidemic, ranging from financial insecurity, poor management, and cultures of sexual harassment, must now be addressed. At the same time, employers must also look at what is enabling people to stay healthy and invest in boosting the underlying dimensions of wellbeing that allow people to thrive.”

Source – Consultancy . co . uk